As the owner of an online business—part copywriting agency, part digital product e-commerce—I have to manage my cash flow and small business budget with precision. That means sticking to a meticulous budget for spending and paying myself on time (weekly). It also means taking some risks like investing: hey-o ads, hiring, contractors, etc.

But hoo boy, has it been a messy process to get here. 😱

Learning how to pay yourself never occurred to me until oh, … 12 months into entrepreneurship. Whoopsadaisy! The Blueprint Model by Shanna Skidmore rocked my world in 2017, but I’ve since coupled that with some other tricks and tips—that’s what I want to talk about in this post.

If something like figuring out how to be a better steward of your creative small business financial management, how to pay yourself, or how to up your profit margin (whether you want to up sales or not) isn’t on your annual goals list, you’d be one in a million: According to statistics reported by the Small Business Administration (SBA) in 2019, about 20% of business startups fail in year one. (source)

We know this, we hear it all ze time.

In this post & episode, you’ll find—

- How to set your own small business budget

- Ideas to divide it into categories

- How to pay yourself as an LLC (Profit First method die-hard over here!)

- Plus, you’ll also get a peek into what my day-to-day finance workflow looks like on Fridays—my #FinanceFridays routine.

Let’s do it!

How to Create a Small Business Budget

I love talking about this because I stuck my head in the sand for 12 whole months in my business. I was the girl constantly in math coach class from 3rd grade through college, I just figured I was bad at math for life.

Fast forward to entrepreneurship, and I didn’t pay myself regularly my first 11 months in business. 😫🙈 It was awful. I was terrified all the success would disappear (I was good at marketing, so I just sold, sold, sold … and didn’t work on the whole business operations side of things), so I hoarded anything I made, keeping it tucked right where it landed in the business bank account—NEVER in my (family’s) pocket. Finances terrified me. I had no CLUE how to pay myself as an LLC … so I just ignored that problem.

This lead to as many marriage arguments as you can imagine it did. 🙃

It was an absolute blessing when I met my now good friend Shanna Skidmore: My husband and I worked with her together through The Blueprint Model, her curriculum for small business financial management. LIGHTBULBS everywhere, it changed my entire pricing structure … I went down from like, 32 annual clients to 17, and upped my profit margin. I’ll spare the whole story, but in a nutshell, I equated more clients and hours working to more MONEY in the bank. I said yes to EVERY job that came my direction, and exhausted myself in the process … until Shanna’s process & small business budget template gutted my dismal financial set-up.

Now days, I want to live free from the love of money and stuff, and instead, understand finances so I’m not afraid of finances (in lieu of immaturely acting like it’s not a thing, which I’ve also done (a-hem, year 1 after college with my first paycheck)—this way I can honor God and my family, steward our funds well, and give generously.

Here’s an overarching view of how I NOW set-up my annual small business budget, and how I have since 2017.

By the way, I am not a financial expert. Shanna is, I am not. I’m not the most profitable business on planet earth. I do, however, run a business I started in 2016 that’s hits around $1M in annual sales, employs 4 women and roughly 10 contractors, and hits around 60%::40% in costs::profit. In full disclosure, I worked in a marketing firm prior to this job … not in finance!

Every year, Shanna launches The Blueprint Model—I’m leading a crew through it again when it opens on Feb. 17, if you’re interested! Click here to learn more.

Here’s what I do.

Step No. 1: Start with your “enough’ number:

what do you NEED to make

I base my salary off of what I know my take-home needs to be.

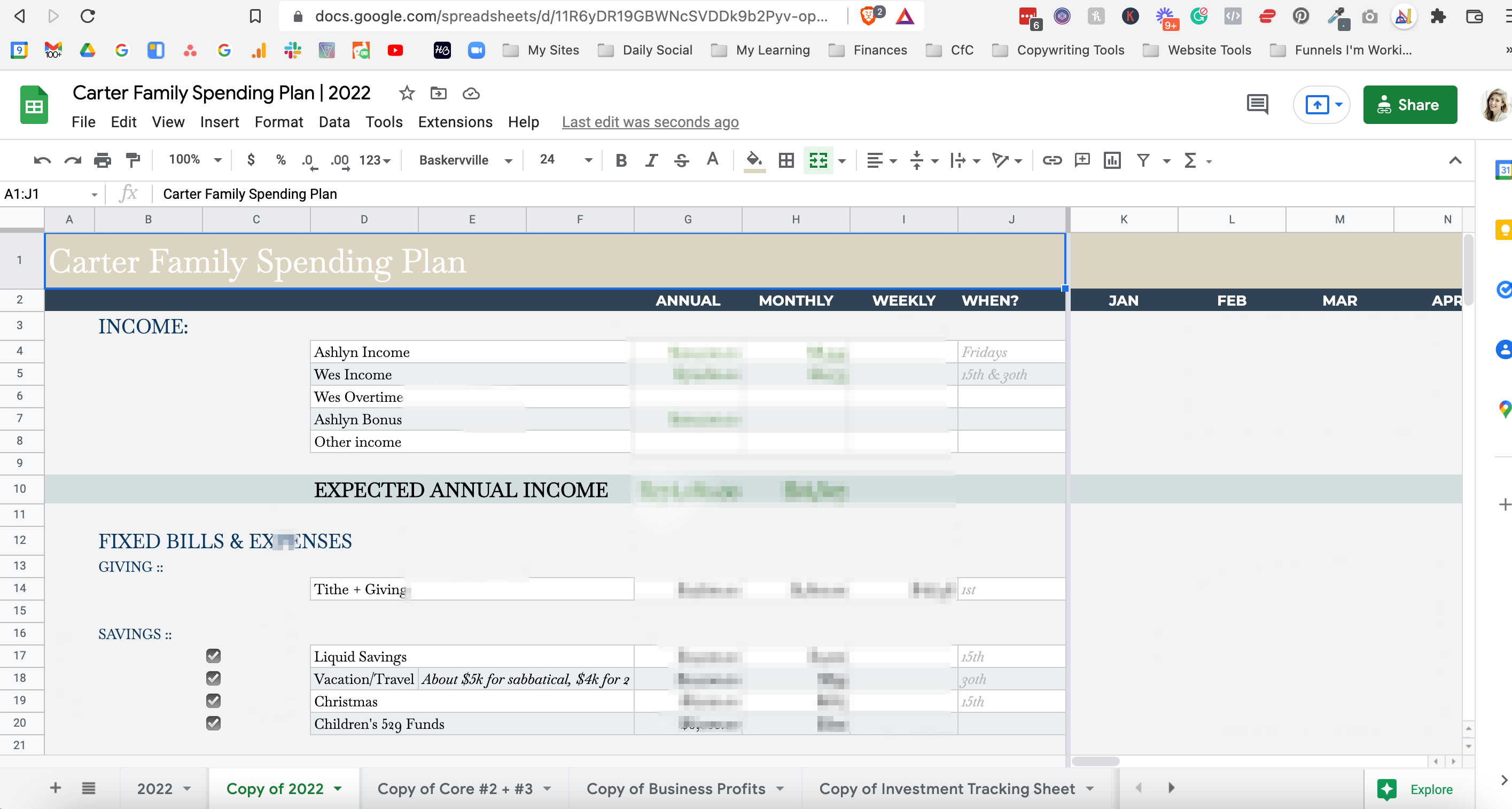

The easiest way to get a clear idea of how much you should spend in each category is by using an online budgeting tool like Mint.com and knowing your spending plan, but I’m kinda anal about knowing every detail: so that we have an estimate for what’ll happen with our money during any given year (plus it helps when planning). The more specific the details are on where exactly money goes throughout these categories—even if they seem small or non-essential at first glance—tends to providing greater clarity in the end, in my opinion.

(Tools note: I make this on a Google Sheets spreadsheet and duplicate to a new tab/update it every year. Once it’s “finalized” for the year, I use Mint.com to create budgets.)

Step No. 2: Find out how much it

costs to keep the lights on in your business

Now, we need to find the overhead. I move over to my small business budget template for this part.

Softwares, payroll .. when you first start you probably don’t have an avalanche of costs—at least for my copywriting & calligraphy business, it was kinda just me and some software apps.

The process of writing down every single business expense in a year pulls me OFF our family spreadsheets and into my business Blueprint. My annual Blueprint Model template includes a tab with business expenses mapped out and cost of goods broken down (plus a financial projections tab, but we’re not there yet!).

Here are my major categories—

I. Office

II. Business Reserves (Savings)

III. Business Travel

IV. Insurance (I definitely didn’t get this right away, ah!)

V. Marketing/Promotional

VI. Professional Services (attorney, coaching, CPA fees, etc.)

VII. Software

VIII. Team

Step No. 3: Set your pricing based off of a blend of what you need to make, industry standards, and supply/demand

Craft your pricing through the lens of what you NEED to make—with respect to industry standards & supply/demand. I kinda hate the “follow your heart and the money will follow” b.s. … that’s not a way to set your pricing and sales goals!

Roughly, if you need your.services to bring in about $100,000, and a package is $4K, then you need about 25 clients, or about 2 a month. If that sounds exhausting, maybe you need to raise your prices a bit.

Some rules of thumb? I try to stay around 60% costs to 40% profit as a profit margin. You may can run 50% costs to 50% profit if you have very, very little overhead. If you have a bigger team, payroll will be a chunk, maybe you’re more 70% to 30%. I track all this every week, I’m always looking at our numbers, which brings me to … the #FinanceFriday routine itself.

Interested in batch workdays? Click here to watch & find tips about how to set up a batch day workflows for your business.

Behind the Scenes: How I Organize My Weekly #FinanceFriday Routine

This routine makes perfect sense for Fridays: I’m excited about the weekend, ready to play with my kids, and have no calls/meetings.

So? I roll up into the office with my workout clothes on, skincare/Olaplex bun in place, and do this first thing in the morning. It takes about 30 minutes to an hour(ish), and serves as my money weekly check-in for our business (and family).

If you want to knock out your small business’s money date in a couple of hours a week, run through the glitter tunnel: here we go!

Also I hashtag Finance Friday in my head when I say it, so there you go. 🙂

Finance Friday Step #1:

Categorize personal & small business expenses

As a small business owner, this is vital for our family finances—I’ll start with family first because I’m the bookkeeper of the family. The easiest way to do this is through a budgeting system tool like Mint.com. Again, up above I mentioned how I track in HIGH detail our budgets year to year for different things. All I’m doing on Friday? Sorting the previous 7 days’ expenses into the right category.

Was that Target order baby formula or a gift for someone … what was that Amazon purchase … etc. Most of these apps learn your habits which is nice—Chick-fil-A expenses are always filed to restaurants by the Mint.com bots in my account, for example.

For business expenses, my bookkeeper Madison (hi, Madison!) organizes every transaction from my business. I used to do this on my own … a bookkeeper was one of the first 3 contractors or things I outsourced!

All I need to do for the business expenses is pop into Slack and make sure she doesn’t have any outstanding questions about where things need to go.

BTW, bookkeeping is the recording of financial transactions and accounting is the analysis, reporting, and summarization of the financial data. <<< I didn’t really know the difference when I started my business!

Finance Friday Step #2:

Pay off all credit cards

Personal credit cards are paid off weekly. For the business (I know Dave Ramsey folks are cringing), I’m a big fan of credit cards. Hear me out!

That’s a Profit First method learning—if you’re disciplined enough, there are some great points systems and rewards out there, like cash-back, travel points (hello, flights for work!), etc. I pay them off in full on the 10th and 25th of every month.

I do believe in carrying some debt (ex. as a family as we’ve established a line of credit, but divvy it up between big expenses and what’s in who’s name, like the house and our 2 cars) … and I also believe at times you have to spend money to make money as a business owner. Dyed in the wool from a book my grandfather gave all of us granddaughters to read, I grew up a really big fan of Dave Ramsey. But now as a business owner, I think sometimes it’s okay to go into a bit of debt to start a business. For more on that, listen to this episode of Ben Shapiro interviewing Dave Ramsey—it’s a good, healthy debate on going into debt to start a business or not.

Finance Friday Step #3:

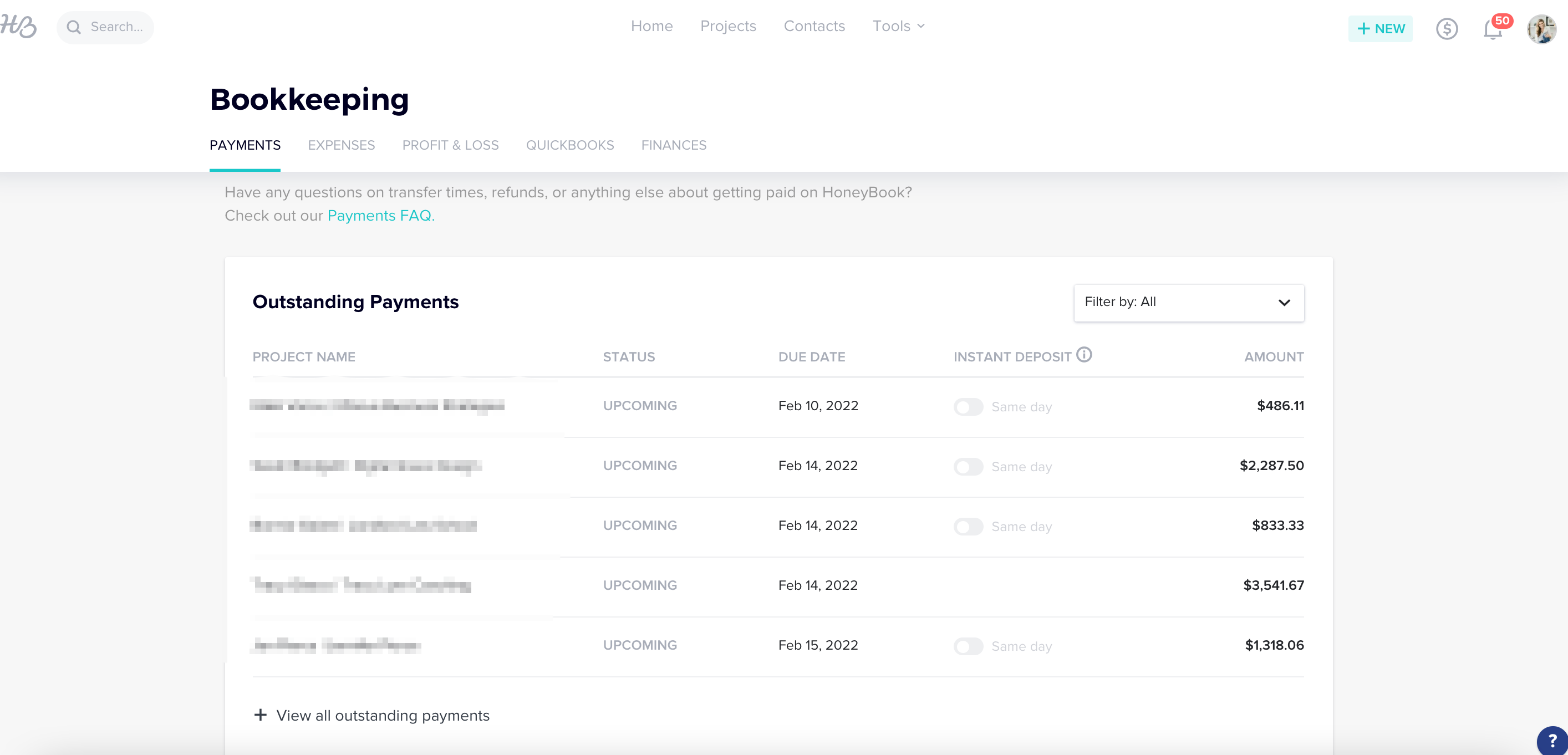

Ensure accounts receivable are paid up

Time to get all the money in the pot! Accounts receivable is the process of making sure you’re paid. If your small business has hundreds of customers on payment plans (this can happen FAST if you’re a course business), I recommend a dunning service like Gravy. I hated chasing customers down … think about when your credit card expires, do YOU go tracking down everything you’ve got a membership or payment plan on with it? I sure do not, ha! So yes—outsource to a Gravy when you can! We ❤️ them.

I hope into HoneyBook (the client relationship management tool we use) and make sure there aren’t any payment issues with our clients. It’s pretty easy to just click the “remind” button under bookkeeping and an auto-drafted email I’ve written is triggered to send to the client reminding them to pay.

You may also be interested in: 5 Tips to Get Started with Honeybook

Then, I’ll pop in PayPal and see if that’s all cleared out and transferred to my income folder …

… this is essentially the digital version of making sure there isn’t $20 in my pocket. 😉

Finance Friday Step #4:

Pay yourself with a small business budget “envelope system”

Now we’re at the fun step—paying yourself!

I love Mike Michalowicz’s Profit First method for small business finances. The premise is simple: you *probably* won’t miss 10% of what you bring in every week or month, and you can challenge yourself to make do on 90%. So? Put the 10% somewhere incrementally, and pay your future self first. It’s brilliant. Read it.

Here’s my hot tip from him: Set up an “envelope” system of sub-accounts in your business bank account.

EACH time you get paid, whether clients, courses, products, affiliate fees—it goes to the main folder/account. The pot.

Every single Friday, I get to log in and see how much we made that week—yay! This serves as a killer gut check, too. I can eyeball when we’re having a great week, or when things are quiet in the small business budget.

Then, I divvy it out. I put …

- 10% to profit

- 15% to taxes

- (Currently) 55% in operating expenses

- 20% to owner’s draw

In his book, Micahelowicz gives a great plan of HOW to find what percentages you should use, btw, but those are the #s I landed on.

The credit card, where ALL the expenses are going, is always paid out of the operating expenses (OPEX) folder.

Your salary is a business expense, so it comes out of owner’s draw (or OPEX).

The taxes folder is for taxes and the 10% gets to build bit by bit for savings (and future investing).

**Note: If you don’t have a payroll system running or an auto-withdrawal scheduled, you also need to pay yourself as an LLC in this step. Mine is on payroll, but in my first couple of years in business, this step meant paying my contractors via Paypal.

Finance Friday Step #5:

Make any calls or send any emails to your CPA, financial advisor, or bank

Last step! If there’s anything admin or calls I need to make as I review small business budget tasks, here’s where I do that.

Note—I don’t have to do this every week. It’s just a bookmarked time in case I need to reach out to someone.

Finance Friday Step #6:

Add stats to your weekly tracker

You want to make sure that you are tracking the right small business finances & key performance indicators! The stats I’m always looking at are sales from various parts of the business—overall, shop sales, client services sales, affiliate sales, giving, ANY refunds.

Read Traction by Gino Wickman for more info on this. Solid read if you’re in business solo, solid read if you’ve got a team!

And that’s the routine!

Every Friday I do these steps, I have since 2017 when I first worked with Shanna. I’ve expanded it as I was able to then hire a bookkeeper, once I read Profit First method… now my system is a big blend of The Blueprint Model meets Profit First method meets, just how I want to run the business financials.

6 Monthly Small Business Financial Management Tasks

As a bonus, my monthly small business financial management workflow is as follows:

- Review monthly PnL financial statements :: Actually taking time to study the monthly financial report my bookkeeper made, of where our money comes in and where it goes out.

- Clean out operating expenses that we don’t need in ASC, LLC :: “how’d we get *this* software subscription??” Yeah. This is when I cancel these. I go through my small business budget template and see what I can delete as an expense.

- Schedule appt with my CPA/check-in with him

- File taxes quarterly

- Schedule Carter State of the Union w/ Wes :: I look and see where we landed with our personal budgets so I can talk to him about that. We look at how we’re doing with our family Blueprint and my business financial Blueprint, so we can see that we’re being intentional with our saving and our spending.

- Schedule meeting with my bookkeeper :: She reconciles accounts, and this is a time for us to check-in.

If you’re interested more in my journey financially as a business owner, here are a few other blogs and videos:

The Surprising Way to Make More Money in Your Business

How to Pay Yourself as a Creative Entrepreneur

Where to Spend Your Money as You Build a Creative Biz: Small Business Investment Tips

The 10 Biggest Mistakes I’ve Made as a Creative Entrepreneur

Again, I hope that helps you out!

If you’re serious about getting financially set in your creative business, don’t forget my freebie. I walk you through how to divvy up your work into each day. All the steps I went through to craft a small business budget template I can use year after year are inside!

Did I leave anything out? Are you going to use this workflow? Let me know below!

LOVE THIS SLASH NEED IT BACK-POCKETED FOR LATER?

CLICK BELOW TO PIN IT!

Reading Time: 11 Minutes Reading time: 11 min. As the owner of an online business—part copywriting agency, part digital product e-commerce—I have to manage my cash flow and small business budget with precision. That means sticking to a meticulous budget for spending and paying myself on time (weekly). It also means taking some risks like investing: hey-o ads, hiring, […]

Die-hard Profit First fan here, too!!

It changed the game for me——the folders 🤯🤯🤯

Do you have Google Sheet Budget Template?

Hey, Karissa! I do not, because the one I would sell if I could would be a riff off of what I learned from Shanna Skidmore’s Blueprint Model. 🙂 She’s my go-to! She has a free class coming up (https://shanna-skidmore.mykajabi.com/a/2147504545/NXxb38m2), but her website has great tips all over it.

Profit a first fan here too! I just started implementing Finance Fridays a few weeks ago and this gave me some great ideas to add to my checklist. Thank you for this! 🙂

YES, Crystal! Clearly I’m a PF fan, some of the techniques work so well in a Finance Friday plan. 🙂 You are so welcome——let me know if you have any questions!